It’s officially the second week of December and AWS re:Invent 2019 has come and gone leaving behind a wealth of announcements and information for the industry to process.

With over 60,000 attendees it’s easy to see how the conference can be overwhelming. Densify was privileged to be in attendance this year as both attendees and sponsors of the conference, and, in lieu of aggregating announcements and data, I’d like to share some key insights to consider.

The Rise of Arm-Powered Instance Types

At the conference, AWS announced a variety of new EC2 instances. What’s notable is the launch (preview) of the M6g, C6g, and R6g instances, which are powered by Arm-based AWS Graviton2 processors.

These new general-purpose instances deliver up to 40% improved price/performance over the current generation M5, C5, and R5 instances. These instances are powered by new AWS Graviton2 processors that use 64-bit Arm Neoverse cores and custom silicon designed by AWS, built using advanced 7-nanometer manufacturing technology.

These instances are an opportunity for AWS to differentiate itself in the cloud market and creates more competition for enterprise chipsets, which should push the market forward. Arm has traditionally suffered from limited software compatibility and this announcement should be a call to action for larger software vendors to ensure synergy. If you’re already deeply embedded in open source software distributions (RHEL, Ubuntu, SUSE, etc.), container services (Docker, ECS, EKS), and utilizing developer tools like AWS Code Suite or Jenkins these instances might be a good fit for your business.

Continued Focus on Customer Experience

AWS is always expanding its services and AWS Compute Optimizer is no exception. This new service introduced by AWS is meant to help optimize compute resources for workloads, providing resizing recommendations across instance families (M, R, T, and X) for EC2 instances and fixed-size ASGs.

As with all new tools, there are limitations, and this is no exception as today it’s only available in the 3 main US regions, Ireland and Brazil. The other key limitation is one that many AWS services have, it’s designed for AWS alone. AWS is the clear frontrunner today in the public cloud wars; many organizations are adopting multicloud or hybrid cloud strategies.

Andy Jassy at the conference made a case for Amazon’s continued competition. From highlighting failures such as Amazon Fire phone to noting the success of New Relic and MongoDB in the face of products like CloudWatch or DynamoDB, there was an emphasis on the notion that there is room for a variety of competition even in markets in which Amazon directly competes. In his words, Simply because we launch a business doesn’t mean it’s lights out for other competitors.

His focus was on the importance of the customer experience. This is how competitors are differentiated and will continue to outcompete Amazon’s internal services and tools. Whether this is oratory service or not, there will be a continued market for competition regardless of whether a business focuses on a single or multiple cloud strategy.

AWS Partner Enablement

Aligning with the ideas that competition is inevitable and customer service will be a key differentiator, AWS launched a new APN Global Startup Program at re:Invent to help technology partners grow their cloud-based business.

The APN Global Startup is a unique, white-glove support and go-to-market (GTM) Program for selected Startup APN Partners so that they can build on their AWS expertise, better serve shared customers, and accelerate their growth. Densify has been selected by AWS to join the APN Global Startup Program.

In comparison to Microsoft, who has a long history of partner enablement, AWS partner programs have been less developed. AWS continues to close the gap with new initiatives and programs and now boasts that it has helped tens of thousands of companies launch their businesses successfully with the AWS Partner Network since 2012.

AWS is approaching partnerships differently and is starting with the customer experience and helping businesses develop strategies to deliver software and services built on AWS that end customers can trust. As the complexity of the cloud continues to grow and new AWS services/architectures for software and service delivery are created there will be a continued need for partners to provide both tools and services to enable accelerated cloud adoption.

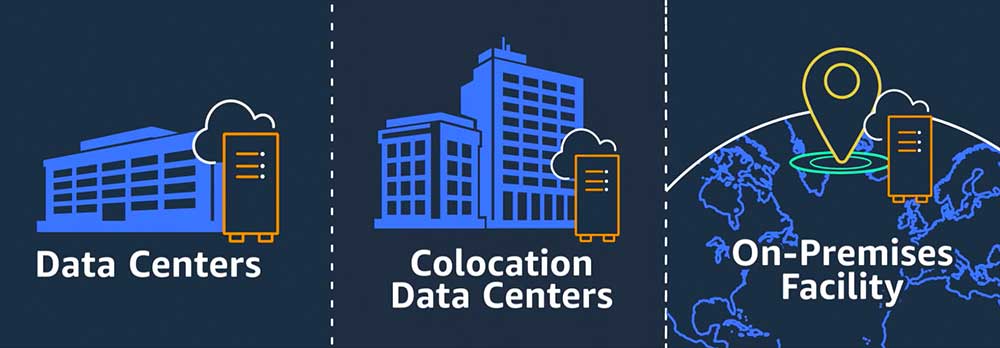

Establishing Outposts for True Hybrid Cloud from AWS

During the keynote on Tuesday AWS announced that Outposts are now generally available for order.

AWS Outposts are a fully managed service that extends AWS infrastructure, AWS services, APIs, and tools to virtually any data center, co-location space, or on-premises facility for a truly consistent hybrid experience. AWS Outposts is ideal for workloads that require low latency access to on-premises systems, local data processing, or local data storage and maintain a continuous connection to the local AWS region.

Also announced was that a VMware SDDC version of AWS outposts would be available early in 2020. The partnership with VMware is strategic for AWS as most on-premises virtualization today is done with VMware software and VMware Cloud is an offering that already creates extensibility between the local datacenter and cloud.

These products are strategic and are meant to compete with Google Anthos and the growing variations of Azure Stack available today. Although AWS will continue to shy away from using ‘multicloud’ as a part of its language, they are clearly focused on enabling hybrid cloud environments for customers needing localized AWS and VMware services.

Heavy Investment from AWS in Containers

Andy Jassy noted at the conference that You can expect that you will see a significant amount of continued investment in all our kind of key building block services. You can expect us to continue to invest very aggressively in compute and storage.

There were eight areas where noted where there would be guaranteed development. Containers were one of these focus areas, which is not a surprise considering the Kubecon conference just two weeks earlier saw growth in attendees from 8,000 to 16,000 attendees year-over-year.

AWS recently released three new features to address customer pain points when building and operating sophisticated container-based applications. Managed node groups for Amazon Elastic Kubernetes Service make it easier to add workers. AWS FireLens is a custom log routing feature that allows users to forward container logs to storage and analytics tools by configuring their task definition in Amazon Elastic Container Service (ECS) or AWS Fargate. AWS also added Amazon Elastic Container Registry Event Bridge support based on customer requests to be able to start a build process when new container images are pushed to Elastic Container Registry.

Fargate is a serverless tool that allows customers to run at the task layer instead of having to worry about the servers and clusters underneath the containers. It’s likely that the focus and investment from AWS in the area of containers will continue to be on their own services, specifically ECS and Fargate, as opposed to their Kubernetes based container services.

Final Conclusions from re:Invent 2019

When you’re building your applications and services, design for inclusion. At the end of the day, every customer and their journey is different and having intentional diversity in design and development will enable your business to succeed in customer experience.

AWS offers four times as many cloud computing instances as it did 2 years ago. Amazon is going to continue to improve and expand its popular services, creating more choices for customers at the cost of additional complexity. This complexity will ensure that the AWS partner ecosystem is diverse and continues to grow to ensure that customers have the tools and services required to successfully develop and manage their products on AWS.

While other cloud providers continue to invest to match the IaaS and PaaS services AWS already has, Amazon will continue to focus on both new services and making their existing services better to maintain their cloud dominance.

Amazon is also taking chip building seriously. While Arm software support is still quite a bit behind the rest of the industry, the launch of the Graviton2 based processors build in house signals that AWS thinks chip development might be a serious differentiation in the IaaS space.

While 2019 numbers have not yet been released, Gartner notes that in 2018 revenue analysis that AWS accounted for 49.4% of the IaaS market share. Whether you’re an SMB or enterprise, AWS has services that can enable your cloud adoption, grow your business, and get you to revenue quicker, making it a sure bet for adoption for the foreseeable future.